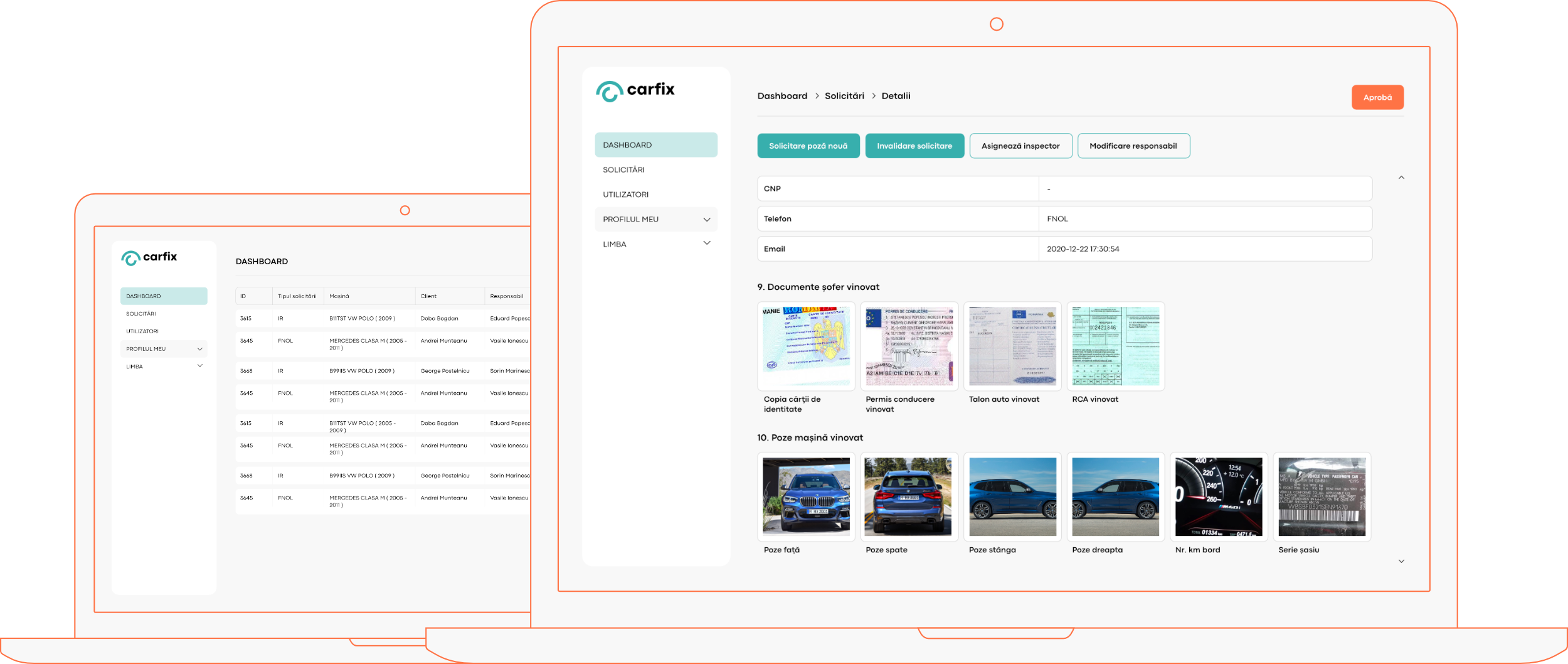

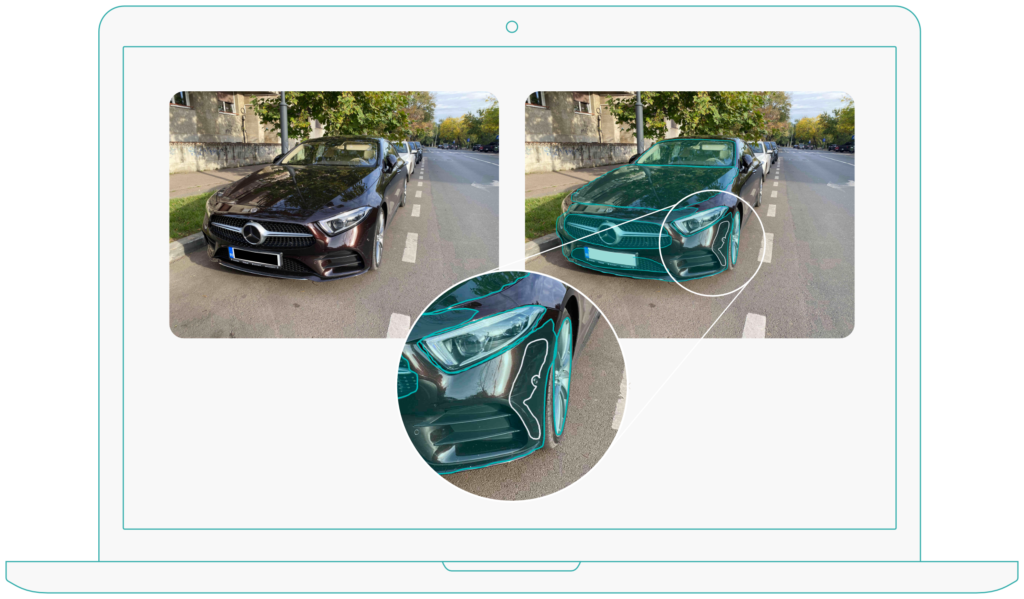

The app that digitises and automates motor claims and risk inspections

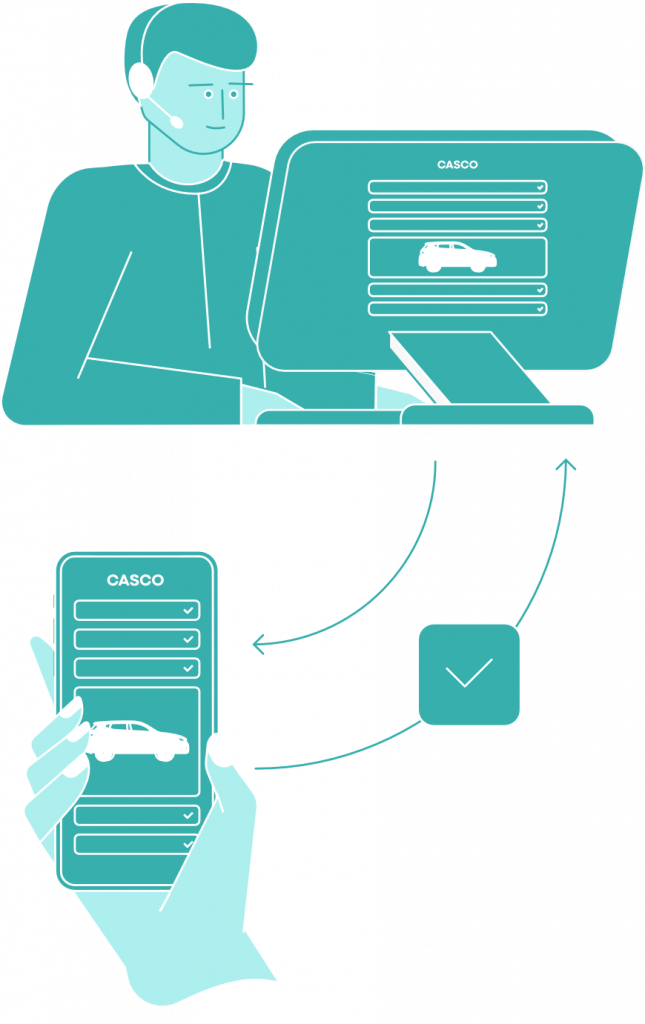

The entire procedure of data / picture capturing is outsourced for free to the customer, in a process 100% guided and controlled by the application. In the same time, the application facilitates the remote completion of a risk inspection, in order to activate an optional insurance policy.